TC2000 Brokerage Review: Winner Best Trading Experience 2020

Detailed Review - Is TC2000 Brokerage Good or Great? Buy Stocks, Options & ETF's directly from Charts. Commissions, Software &, Customer Satisfaction.

| Commissions & Trades | (3.5) |

| Broker Trading Platform | (5) |

| Customer Support | (5) |

| Customer Satisfaction | (5) |

| Regulation & Protection | (5) |

| Account Opening Balance | (5) |

Summary

TC2000 Brokerage: Recommended for Investors buying Stocks, Options & ETF’s directly from Charts using award-winning TC2000. Also, take advantage of low margin rates. TC2000 Brokerage is a relatively new offering from Worden Brothers Inc. This is a well-established company offering one of the best Stock Market Analysis Software Packages around. And boy they did a good job.

4.8

PROS

- Excellent Trading Platform

- Excellent Trading From Charts Implementation

- Very Low Margin Rates

- Excellent Customer Satisfaction

CONS

- Excellent Trading Platform

- Excellent Trading From Charts Implementation

- Very Low Margin Rates

Best for Investors buying Stocks, Options & ETF’s directly from Charts using award-winning TC2000. Also, take advantage of incredibly low margin rates.

TC2000 Brokerage is a relatively new offering from Worden Brothers Inc. This is a well-established company offering one of the best Stock Market Analysis Software Packages around. The logical step for Worden Brothers was to expand into the Brokerage side of the business.

And boy they did a good job. They offer Stock Trade commissions at $4.95, $2.- less than TD Ameritrade and Merrill Lynch and their options trade fare even better at $2.95 + $0.65 per contract.

They surprisingly lead the pack in Margin Interest Rates. When you buy a stock with margin, it enables you to leverage that stock with borrowed money. This is traditionally where brokerage firms make a lot of profit, through this lending.

However, TC2000 Brokerage does not take advantage of the client in this area and simply offers very low-interest rates of 3% to 4.2% on the margin loans.

The icing on the cake though is that you get to trade directly off the charts with TC2000. TC2000 enables real-time fundamental and technical screening of the entire stock markets, including ETF’s and enables you to easily create indicators from market conditions. Not only that the options trading in TC2000 is arguably the best in the industry.

TC2000 brokerage only offers trading in Stocks, Options and ETF’s, but is this is all you need then this is a first class operation that should meet your needs.

Round 1 -- Commissions & Trades

If you only want to trade stocks, options and ETF’s and would like to utilize leverage to increase your buying power the TC2000 Brokerage could be ideal for you as they offer an incredibly low 3% to 4.2% margin costs. These rates are available to those with smaller balances also.

Stock Trades are a flat fee of $4.95 and the Options Contracts are $2.95 + $0.65 which is at the median point across all brokers, so not the lowest but far from the highest also.

Lastly, ETF trades are $4.49. There are no commissions free ETF’s available. Outside Stocks, Options or ETF’s there is nothing else to trade. If you are looking for a full-service broker offering everything including Bonds, Forex or Commodity Futures then it may be worth looking at Firstrade or others in our Top 10 Broker Review.

Round 2 -- Stock Trading Platform Winner

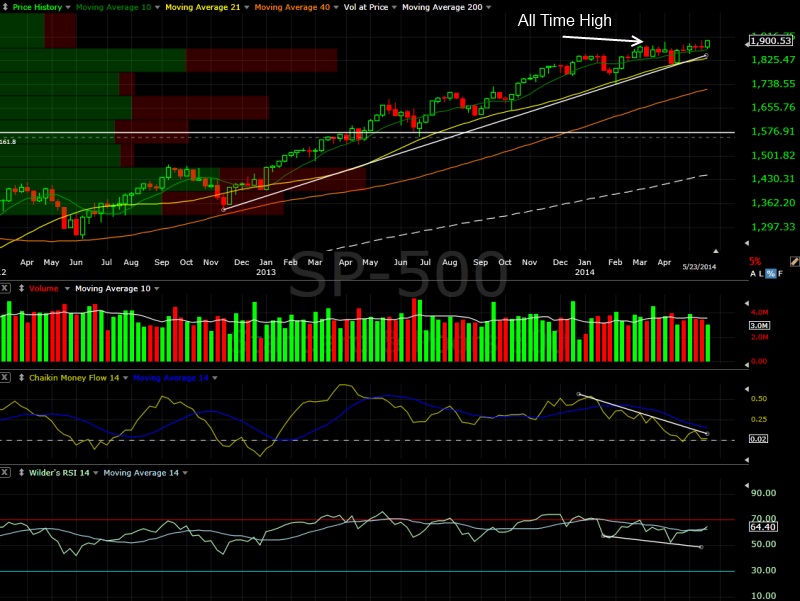

How do you find the stocks that are in-play, have high volatility and are in a strong trend? This is the job of the trading platform.

As you may have noticed in our Review of the Best Stock Market Analysis Software, TC2000 was one of the clear winners.

Worden Brothers continue their winning ways, with very competitive pricing starting at only $10 per month for the Silver package. I would recommend Gold to start with as you get a more powerful alerts engine and unlock the huge power of the Technical & Fundamental Scanning and Filtering that TC2000 is famous for.

TC2000 is aimed squarely at those trading Stocks, ETF’s, Mutual Funds and Options only, specifically on the U.S.A and Canadian Markets.

The software is first class, runs on PC, Mac and Tablets SmartPhones, and requires Zero complex configuration

Support is excellent both on the forums or via the phone where you get to speak immediately with skilled personnel in the U.S.

If you trade U.S. Stocks, ETF’s or Mutual Funds, then this is a great solution. Worden also provides regular live training seminars which are of a very high quality and also tour the U.S.A with free live training seminars for subscribers.

Worden Brothers make a clean sweep when it comes to trade management, with full Broker Integration (as long as you choose them as your broker).

TC2000 also offers fantastic Options trading and integration, you can scan and filter on hundreds of Options strategies and then execute and follow them directly from the charts.

Good Profit & Loss tracking & Analysis round off the package.

Industry Leading Options Trading Visualizations & Live Trading

Options Strategies

Use the Strategies button in the lower left of a chart to open option strategy tickets directly on the chart. The menu divides strategies into bullish, bearish and volatility categories. Strategies include single-leg, multi-leg, and combinations of underlying stock.

Multi-leg strategies open as a single trading ticket on the chart.

How to Use Option Charts & Chains with TC2000 Brokerage -- Video

Fundamental Scanning and Screening

Make no mistake about it, if you want fundamentals stock screeners in real-time layered with technical screens all integrated into live watch lists connected to your charts Telechart is a power player.

I selected TC2000 as my tool of choice back in the year 2000 because it offered back then, simply the best implementation of fundamental scanning, filtering and sorting available on the market. 17 years later, they are still a leader in this section.

They offer a huge selection of fundamentals to choose from, but what makes it unique is the fact you can, with a few clicks, create your own indicators based on the fundamentals.

You can then overlay the indicators directly on the charts, which opens up a whole new world and technical and fundamental analysis. 10 out of 10 for TC2000 again.

Round 3 -- Customer Satisfaction Winner

TC2000 has an avid following, I know I am a member of the forum and long-term member.

They receive a 5-star rating for customer satisfaction.

The support covers chat, phone, and email and I have been in contact with the support desk and they are skilled and effective operators who resolve issues immediately.

The only area in which they do not excel is in the research and news services included. You can pay an extra $8 per month to get integrated MT Newswire, but the selection does not compare to the offering from Firstrade or Interactive Brokers.

Round 4 -- Brokerage Regulation & Account Minimum

Is the company well established, well funded and well regulated? This is the main object of this round of comparisons.

Any U.S. based Broker should be a member of the following institutions.

Financial Industry Regulation Authority (FINRA) Membership.

FINRA is a nonprofit organization established to protect investors and ensure that the members are complying with the law and the Securities and Exchange Commission rules. They audit all members regularly.

Securities Investor Protection Corporation (SIPC) Membership.

The SIPC is there to protect and hopefully recover any money lost if a Brokerage firm fails. Although Broker failure is rare, it can happen and SIPC membership ensures that your account is protected up to $500,000.